Weekly Blog

Weekly Blog

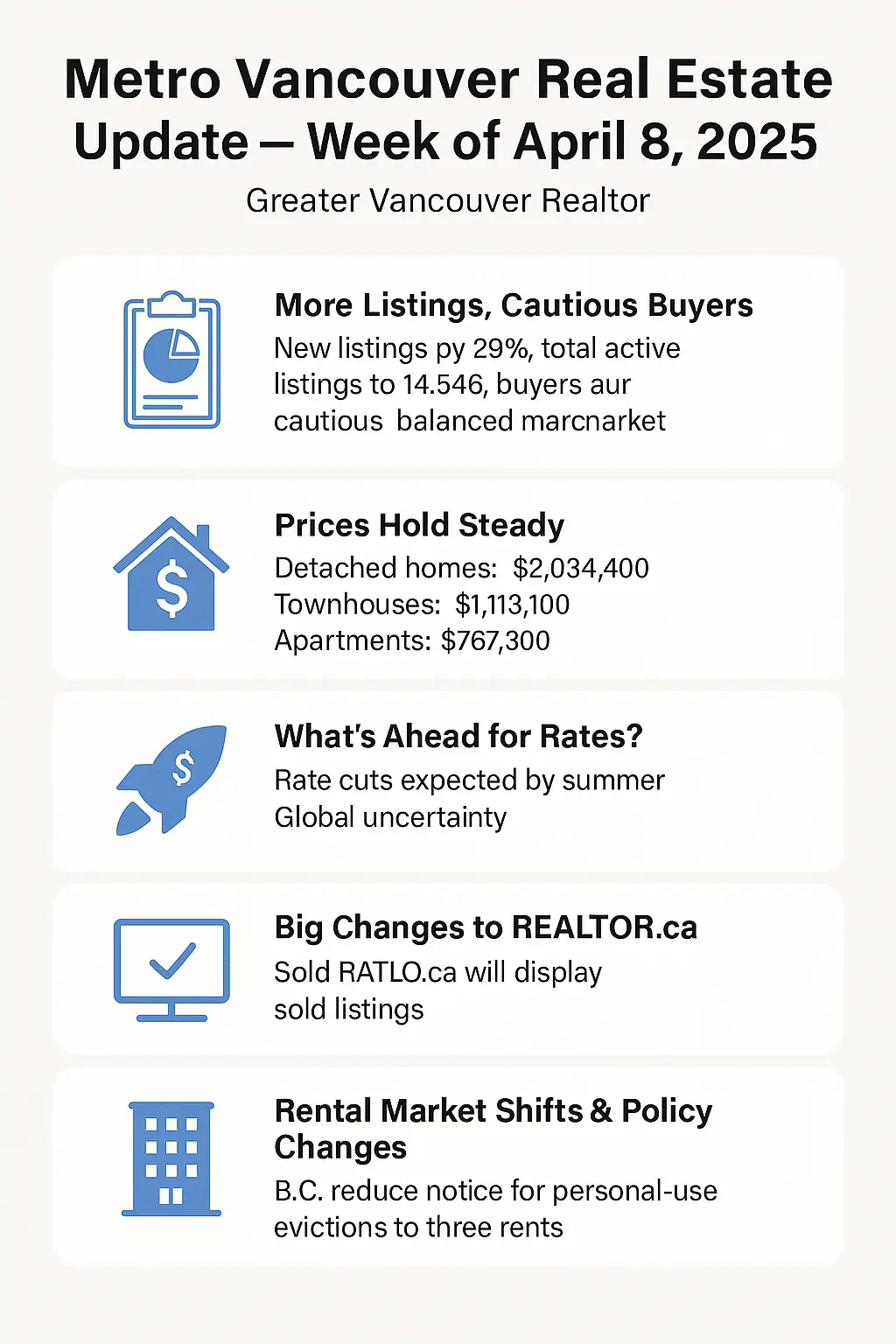

Spring is usually a time when Metro Vancouver’s real estate market kicks into high gear, but March 2025 told a different story. According to the latest Greater Vancouver Realtor Board (GVRB) stats, home sales reached their lowest level for a March since 2019—just 2,091 properties were sold, marking a 13.4% drop from last year and sitting nearly 37% below the 10-year average.

📈 More Listings, Cautious Buyers

While sales cooled, listings heated up. New listings surged by 29%, and total active listings climbed to 14,546—the highest level we’ve seen in nearly a decade. The market is now sitting in balanced territory with a sales-to-active listings ratio of 14.9%. This shift gives buyers more choice, but despite lower prices and softened mortgage rates, many remain hesitant to jump in.

💰 Prices Hold Steady

Benchmark prices remained relatively flat across all housing types:

- Detached homes: $2,034,400

- Townhouses: $1,113,100

- Apartments: $767,300

This stability suggests that while activity has slowed, underlying demand is still strong enough to support current values—especially if interest rates continue to trend down.

📉 What’s Ahead for Rates?

RBC Economics is forecasting three interest rate cuts from the U.S. Federal Reserve in 2025, with another three likely in 2026. Canada is expected to follow suit, with the Bank of Canada projected to cut rates to 2.25% by summer. However, global economic uncertainty—especially rising import costs and shifting trade policy—could make inflation a bit of a wildcard this year.

🆕 Big Changes to REALTOR.ca

Exciting news for buyers and sellers: REALTOR.ca will now display sold listings, including both pending and closed sales. Even better? Sale prices will be published 30 days after closing. This update offers a more transparent view of the market, helping clients make more informed decisions and conversations with your realtor (like me!) more productive.

🏘️ Rental Market Shifts & Policy Changes

In provincial news, B.C. recently reduced the notice landlords must give tenants for personal-use evictions—from four months to three. Tenant advocates have criticized the move, calling it a setback for renters, especially in Vancouver where housing insecurity is already high. However, vacancy rates are climbing, and rents are gradually falling—March marked the 16th straight month of declining average rents in Vancouver.

With major projects like the Sen̓áḵw development in Kitsilano bringing in thousands of new rental units, renters may find more breathing room in the months ahead.

What This Means for You

Whether you’re buying, selling, or renting, the landscape is shifting. For buyers, there’s more inventory and potential for better deals as rates decline. For sellers, pricing and strategy are more important than ever in a slower market. And for renters, the market may finally be easing up after years of intense pressure.

Have questions about how these changes affect your plans? Let’s chat! I’m here to help you navigate this evolving market with confidence and clarity.

📞 604-968-9886

📧 Hansol.estates@gmail.com